Struggling to make ends meet on $180k because you're spending $80k on childcare

Relatable or ridiculous?

Happy Valentine’s Day! This post is long and has nothing to do with romantic love!

Friends, we’re in the middle of summer camp–planning season, and this shit is expensive. (For those without kids, yes, it’s insane that you have to book camps six months out, but this is how it works.) When my kid was a bit younger, I’d just choose one camp, and he’d go there all summer. Now that he’s older, we do more of a patchwork of different things, which means there are so many forms to fill out and dates to remember and other moms to coordinate with. (Yes, it’s mostly moms who manage camp schedules. If you’re a dad who does this, I want to hear from you!) It probably doesn’t need to be this complicated or quite this expensive, but I want my kid to have a fun summer, so it’s the price we pay. I’m pretty clear-eyed about that.

Complaining about the cost of camp is nothing new. (In fact, I complained about it in this newsletter last summer!) And it’s just one of the many crazy expenses that working families in the U.S. shoulder. Last week, I stumbled upon a LinkedIn post from Lindsay Tigar, co-founder and chief of business development and consulting at Mila & Jo, a media company focused on motherhood. She wrote about a recent article published on financial guru Dave Ramsey’s website about how to save money on childcare. The suggestions were laughable, and Lindsay broke down why each one was more ridiculous than the last. Ramsey’s ideas included using a workplace daycare (a perk that fewer than 6% of U.S. employers offer), relying on family (great if they’re willing and able), and starting your own childcare center. (I think the problem with this last suggestion is obvious, but I’ll drop Megan Leonhardt’s fantastic story from Fortune that details the many stressors facing people in the childcare business in 2023. Suffice to say, it’s a very low-margin industry.)

For the uninitiated, Dave Ramsey is a personal finance celebrity with a syndicated radio show and dozens of books to his credit. He also has a website and YouTube channel. The man has made millions yelling at people about how they manage their money. Ramsey’s work has religious overtones: He’s an evangelical Christian, and his books are peppered with Bible quotes. I’m always surprised and delighted when I meet someone who isn’t familiar with Ramsey, and I feel a little bad introducing him here. If you want a good profile, read this New York Times piece from the great Ginia Bellafante.

Lindsay didn’t link out to the Ramsey story in her LinkedIn post. (I don’t blame her—Ramsey doesn’t need more clicks.) So I Googled “Dave Ramsey + childcare costs” and stumbled upon another Ramsey controversy that’s been circulating for the last few weeks (and inspiring quite a bit of TikTok backlash). Last summer, Ramsey and his YouTube cohost Jade Warshaw took a call from a man, Dave in Philadelphia, who is struggling to get by on $180,000 a year. The man explained that the problem is childcare. He and his wife are paying close to $80,000 a year to send their two children to daycare. Tuition is $25,000 per kid, and they pay extra for before and after care. They hire a nanny during the summer months because the daycare isn’t open year-round.

Tiktok failed to load.

Tiktok failed to load.Enable 3rd party cookies or use another browser

Philadelphia Dave asked Ramsey and Warshaw if it would be okay to take out a personal loan to cover the cost of the childcare, in part because his wife is a medical resident, and in a couple of years, when she becomes a doctor, her salary will dramatically increase. I’m not sure why Philadelphia Dave thought Ramsey, who denounces all forms of debt, would approve of this idea. Of course, he did not. I should also not be surprised that Ramsey and Warshaw were shocked that anyone was paying so much for childcare—and yet I was. These are so-called personal finance experts, and the cost of childcare is a huge crisis in the U.S. But it seems that these two don’t have a goddamn clue.

“Are they going to Harvard?” Ramsey asks.

“There’s cheaper routes,” Warshaw insists.

“It’s a pretty fancy daycare,” Philadelphia Dave concedes. But for Pete’s sake, what even is a fancy daycare these days? Perhaps there’s a slightly less expensive option, but my first thought was: Is a cheaper daycare as safe? And does this imaginary affordable daycare even have space available? There are so many things that parents consider when choosing childcare for their kids. For all we know, this was the only viable option for Philadelphia Dave’s family.

“They’re not even in school, and you’re paying $25,000 a head,” Ramsey says, continuing to act shocked by this info. “C’mon, dude. That’s just dumber than crap.”

Honestly, when Ramsey tells Philadelphia Dave that paying $25k per kid is dumber than crap, I don’t know whether to laugh or cry or scream. (Though every time I watch the clip, I definitely feel my blood pressure rising and my chest tightening.) Truly, the only thing that Philadelphia Dave has done that’s dumber than crap is asking for advice from someone as out of touch as Ramsey.

Truly, the only thing that Philadelphia Dave has done that’s dumber than crap is asking for advice from someone as out of touch as Ramsey.

Ramsey and Warshaw continue to go back and forth giving Dave from Philadelphia more ridiculous advice. “Find you a free summer camp,” Warshaw says. (Oh right, free summer camp—I know a whole lot of parents who want to know where to find that!)

“If you can’t find childcare that costs half that, I’m going to open my own,” says Ramsey.

“There’s gold in them daycare hills” adds Warshaw.

“The things we now call necessities in this culture,” says Ramsey, shaking his head in resignation. “That’s not a good investment.”

Then the call ends. And I can’t stop wondering what Dave from Philadelphia is going to do. Is he really going to go home and tell his wife, the medical resident with a demanding job and two small children, that they need to find cheaper daycare? Oh, to be a fly on the wall for that conversation.

I also keep thinking about what I would recommend if Philadelphia Dave was my friend, and he came to me asking what he should do. There’s not a lot of great advice out there on how to save money on childcare because, honestly, there aren’t many great solutions.

How do families make it work? Wouldn’t we all love to know. Some of us are lucky enough to have family nearby to pitch in. Some hit the family-leave jackpot at work, and both parents are able to toggle their paid leave so they can spend the whole first year at home with their child. In other families, a parent might choose to downshift their career, to care for their children either part or full-time. Some people are choosing to forgo typical childcare arrangements altogether, working full-time and cobbling together care, as my friend Rebecca Gale detailed in a recent New York article. All of these options (save the paid-leave jackpot) have obvious pros and cons. Many leave parents cash-strapped and exhausted.

I was chatting with my friend Priya Malani, who is the founder and CEO of Stash Wealth, on Monday morning, as I was in the midst of writing this piece. I was curious if any of her clients ever took out personal loans to pay for childcare. She didn’t think so, but she also didn’t think it was the worst idea she’d ever heard.

Priya first wanted to know if the family had an emergency fund and term life insurance policies—some sort of backup plan if things went south. Of course, Ramsey was too busy making fun of the caller to ask for that info. He did ask how much debt the couple had, and Philadelphia Dave shared that he and his wife have a mortgage, and that he has $25k in student loan debt. Frankly, that doesn’t feel like a ton of debt to me, because with the right refinancing or payment plan (depending on whether the loans are private or federal), you could probably get those student loans down to a fairly reasonable monthly payment even if you’re paying them off for the next 20 years. There was no mention of credit card debt. And his wife was wrapping up her medical training with no debt, which is amazing!

With what little information we had, Priya didn’t think of it as entirely crazy for the couple to take out a small personal loan to help make ends meet and pay for childcare while Dave’s wife finishes up her residency. Of course, they should have a very clear repayment plan. But Priya and I agreed as we walked and talked that the couple should reframe their situation and see the childcare payments as an investment in their future. This is money they are spending now so Dave’s wife can take her career to the next level.

The couple should reframe their situation and see the childcare payments as an investment in their future.

Priya and I aren’t privy to this couple’s financial information, so it’s impossible for us to give real advice. This is just one thought we had during a casual conversation. And honestly, he may have sold millions of books, but Dave Ramsey isn’t qualified to give advice either, because he had about 30 seconds with this caller. His YouTube show is more entertainment than anything else—though I don’t really see what’s entertaining about a grumpy, out-of-touch Boomer berating stressed-out callers who need real help. That said, Philadelphia Dave and his wife could benefit from meeting with a CFP or other fiduciary advisor to get advice on their next steps. Having an outside expert offer financial advice isn’t a bad thing, as long as you do your research and make sure you find someone who’s trustworthy.

Perhaps I’m stating the obvious, but it isn’t like this in other countries. Lindsay and I chatted about her LinkedIn post on Monday afternoon, and she told me that her husband is Danish, and they’re often comparing their experiences raising kids with those of their friends who live in Denmark. She started putting her name on daycare waiting lists when she was just three months pregnant, and they had to rely on a nanny share when she went back to work full-time 18 weeks after her child was born. Several months later, they finally got off the waitlist at a local daycare center, but they still struggle to find backup care on the days the center is closed. While Lindsay’s mother lives nearby and helps on some weekends, like many grandparents, she still has a full-time job. Meanwhile, in Denmark, each parent gets 24 weeks of paid leave, and then their child is guaranteed a seat at a government-subsidized childcare center. It sounds magical.

The U.S. is one of the wealthiest countries in the world, and yet our government does almost nothing to subsidize childcare costs. According to a 2021 New York Times article, “the U.S. spends 0.2% of its G.D.P. on childcare for children 2 and under—which amounts to about $200 a year for most families, in the form of a once-a-year tax credit for parents who pay for care.” In Denmark, they spend $23,140 per child.

Most working parents in the U.S. cobble together a shaky system that only really works if you’re well paid and have an understanding boss, healthy kids, and access to good childcare. Otherwise, it’s likely to be a fucking shit show. Sure, maybe it’s extreme that Philadelphia Dave spends $80k a year, but there are plenty of families across the U.S. who are spending more on childcare than on their mortgage.

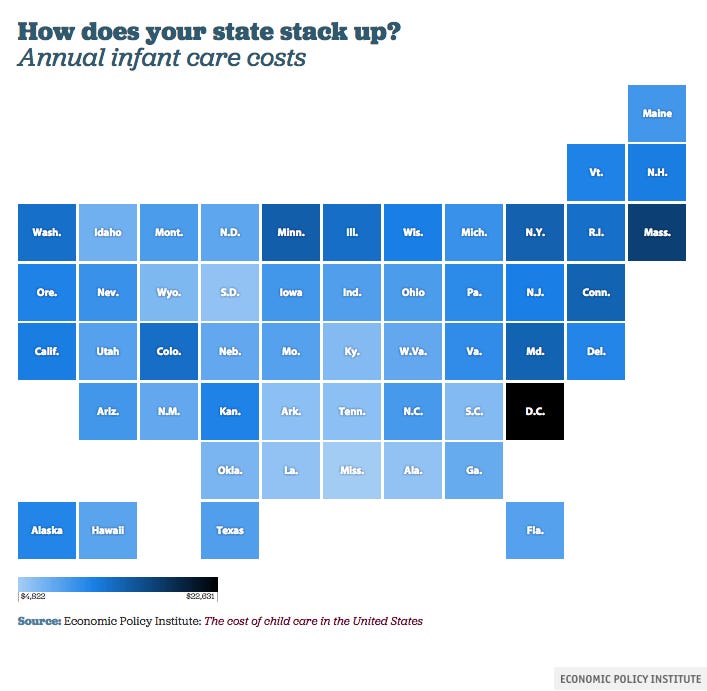

On the Economic Policy Institute’s website, you can see the average cost of childcare and how it compares to the cost of public college and the average cost of housing in every state. According to the data, childcare is most expensive in Washington DC, where the average cost is more than $24,000; in Pennsylvania, where are friend Dave lives, the average is $11,842. Unfortunately, this info is woefully out of date, since it was last updated in 2020. Bloomberg reported in October 2023 that the average monthly childcare payments were 32% higher than the 2019 annual average, according to an analysis of customer data by the Bank of America Institute.

While the Biden Administration argues that Americans shouldn’t allot more than 7% of their take-home pay to childcare costs, a 2024 Care.com study found that, in reality, 60% of Americans are spending 20% or more. And it could get even worse, since all pandemic-era federal government subsidies for childcare centers ran out last fall—the same Bloomberg article estimates that as many as 70,000 childcare centers across the U.S. could close as a result. It seems impossible that anything will change unless our government steps in to help stem the rising costs.

I wish I had a few good tips on how to save money on childcare. The truth is, many of us working parents get by during our childrens’ early years on a wing and a prayer, and in some cases, we have to take on some debt. The only thing that really saves us is that the time is relatively brief. But telling people, “It’s only going to totally suck for a little while!” doesn’t feel like a great answer to this societal crisis.

What do you think? Would you take out a personal loan to pay for childcare? (Or have you in the past?) Or do you know of any good cost-cutting measures that can help you save on this huge expense? I want to hear from you! (But if you comment, please be kind!)

In the meantime, good luck to Philadelphia Dave and his doctor wife. I hope you figured out a workable solution to your problem.

xx

Lindsey

p.s. I’ll add that Chamber of Mothers and Moms First are amazing organizations that are fighting in Washington for real change for parents. I recommend following their work, donating, and pitching in when you can. If we don’t speak up, things will never change.

Thank you for this story. I think it's so interesting that everyone (including several people in the comments) disbelieves that this is how much early childcare costs today. The idea that parents should be exploring "alternatives" (underpaid babysitters? unlicensed in-home daycares?) makes me want to scream.

Thank you for writing this! It’s a story I think about daily and I feel like we’re screaming from the mountain tops about how much it costs and no one is listening. Childcare is our second highest expense each month after our mortgage payment. My kid goes to a good school but it’s nothing exceptional. It’s just wild because as parents we’re told that we’ll have 18 years to save for our child’s education when in actuality we’re paying the cost of college tuition right out the gate for daycare. State colleges in my area are roughly the same price as childcare centers.