This edition of the newsletter is brought to you by our friends at Winne.

I don’t write about my son much because, unlike my husband, Ken, he doesn’t read these essays before they publish, and so he doesn’t get to offer feedback. I also don’t post pictures of him publicly, and I don’t use his name in my writing—I like to give him a little bit of privacy. But I thought this was an important topic to tackle. I’ve also decided to give him a pseudonym, so I’m going to start calling my son “Freddy,” which is a nickname I call him sometimes derived from “Ready, Freddy.” Thanks for being patient and understanding as I navigate how to write about personal things as The Purse audience expands.

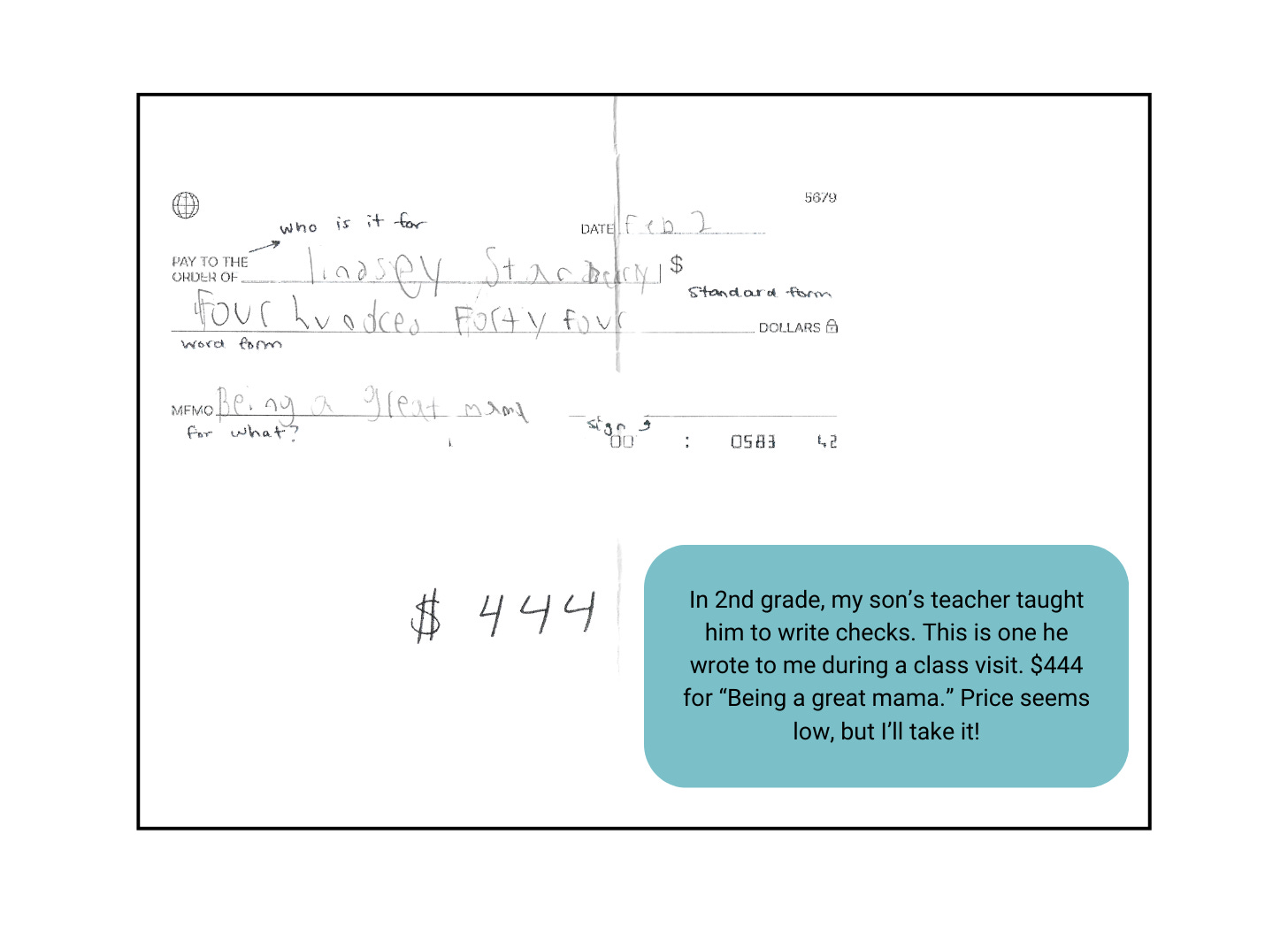

It probably comes as no surprise that my kid asks a lot of questions about money—the acorn never falls far from the mighty oak. But what does surprise me is how completely unprepared I feel to answer many of them. I essentially talk about money for a living, but discussing the topic with my eight-year-old, Freddy, isn’t always easy.

Even when I don’t have great answers, I often find it interesting to see what he’s learning and hearing from his friends, school, YouTube, and the general world around us. Sometimes, there’s a simple answer to his questions, like, “Are we billionaires?” Ha! No!

But other times, the conversations are more complicated. There was a low moment last summer when Freddy told me a friend at day camp said I didn’t love him enough because I wouldn’t buy him a video game he wanted. In the moment, all I could think was, “Fuck that kid!” And my second thought was, “This is why I hate sending Freddy to expensive camps in fancier Brooklyn neighborhoods.”

You can’t say such things out loud, of course. And it’s not exactly fair of me to assume that kid was a rich kid, or that all rich kids are jerks. But I was really hurt by the comment, and I wasn’t sure how to react. I know Freddy knows I love him, regardless of whether I buy him a video game. But as I continue to navigate self-employment, I also don’t have as much disposable income to drop on such things, which is probably why it hit such a nerve.

Everyone is carrying around a lot of emotional baggage, and many of us are trying our hardest not to pass that baggage onto our kids. I want Freddy to have a well-adjusted relationship with money, but the truth is, I’m not even sure what that looks like. I don’t want him to be spoiled or wasteful. I also want to make sure he feels secure and knows that his parents are able to care for his needs, even if we might not always give into every want.

Finding trusted childcare used to feel impossible, but now there’s Winnie!

Years ago when I was on maternity leave, it felt like I spent the entire time stress searching for day care. Every recommendation from a mom friend sent me down an endless rabbit hole of research. That’s why I’m so excited about Winnie. It’s a childcare marketplace that connects millions of parents across the U.S. with day care and preschool options. It’s completely free for parents to use, and you can easily discover high-quality local options with detailed descriptions, photos, tuition info, licensing status, availability, and more. If you’re in the thick of it, searching for day care or preschool, definitely check it out! #partner

There’s research that suggests a person’s money habits are set by age seven. That feels so young, and I can’t help but worry that I already missed the boat! But I’m also not sure I totally buy it. After years of writing on the topic, I’m inclined to believe that our habits and how we feel about our financial situations are always evolving—and it’s not always directly correlated to how financially successful we are. Of course, this is mostly based on my own anecdotal evidence and the many conversations and interviews I’ve had and done over the years. While I do think how we are raised has an impact on how we feel about our finances, there’s also some element of nature versus nurture that’s hard to deny. I can’t help but point to my own upbringing.

I grew up solidly upper middle class. Both my parents were working professionals, and we lived in a nice house, had nice clothes, and drove nice cars. My brother and I both attended private schools for most of our education. We didn’t talk about money much growing up. I knew we weren’t the richest among my friends or classmates. My parents provided us with everything we needed and pretty much everything we wanted. My mom had a rule that she wouldn’t buy it if she didn’t like it, which meant I never owned anything from Abercrombie and Fitch (a big deal in suburban Cincinnati, circa 1997), but I did have plenty from Limited Too, J Crew, and Espirit. (Oh the thrill of back-to-school shopping at Kenwood Towne Centre. IYKYK!)

My brother would absolutely disown me if I were to talk about his financial situation. (He’s probably holding his breath reading this wondering what I’m going to reveal next!) We are very different people. Growing up, I was the girliest girl around—all baby dolls and pink dresses—and he played every sport imaginable. As an adult, I blab about my life to perfect strangers on the Internet, and he long ago deleted his Facebook account. We may have the same parents, but we have very different approaches to life and money. Without doing a deep dive, I think the same can be said about my mom and her brothers and my dad and his siblings. Nurture only gets you so far.

As I started talking to experts about the topic of kids and money, a resounding theme came up again and again. Every kid is different, and so (like all things related to both personal finance and parenting) there isn’t a one-size-fits-all answer for how to teach them about it.

Earlier this year, financial expert Farnoosh Torabi1 had a viral Instagram Reel about her kids doing chores. People had a lot of feelings about her decision to pay her kids an allowance for jobs they did around the house. Her kids are 7 and 10, and she pays them $15 a week to help with various tasks, like making their beds, taking out the trash, and doing the dishes. She requires that they save $10 (which she transfers to a GoHenry account), and she gives them $5 in cash that they can use for whatever they want.

When we chatted for this newsletter, Farnoosh told me that allowance and chores in their household is an evolving project. While the kids were on board during the summer, it’s been harder to keep up during the school year. And she’s also found that her son is not necessarily motivated by the promise of cash. He’s gone so far as to offer to pay his dad to do his chores. You can’t fault him for the entrepreneurial spirit.

2, author of Launching Financial Grownups, had a similar experience when she first started giving her son an allowance when he was younger. He had been expected to do certain tasks around their house, like make his bed and take out the trash—and it was never an issue until Bobbi started tying an allowance to it. He stopped making his bed, telling Bobbi he didn’t need the cash, so he wasn’t going to do the chores.On the blog

There’s a lot to consider when it comes to kids and allowance. Should you tie it to chores? What chores should they do? How much should you give them? And is there a good app or bank to use? Over at the Purse’s new blog, I wrote about (almost) everything you need to know about giving your kid an allowance.3

And yet, Bobbi reassures me that her son is very thoughtful about money and so grateful for everything he receives from his parents. You really have to listen to your kids, Bobbi says, and ask questions to understand their needs and motivations. She’s not wrong: It’s amazing what you can learn when you slow down for a minute and really listen to what your kid is saying.

Of course, it would all be a lot easier if the money conversations were simply about whether or not to give your kid an allowance. I reached out to my friend

, who writes with her husband, Doug. They recently shared a piece Doug wrote about trying to teach his daughter’s Girl Scout troop about saving and investing. Heather admits that Doug probably made it too complicated, and that we don’t necessarily need to be explaining complex economic terms to our little ones.“The first lessons we teach our kids about money should really be about your values,” Heather says, and I couldn’t agree more.

But as Heather and I chatted, we also discussed that it’s more complicated than that. Our kids are growing up in a world of abundance and instant gratification. It’s way too easy to replace a lost water bottle: You just click a button on Amazon, and it shows up on your doorstep the next day. Our kids don’t even have to get in the car and go with us to Target to buy a new one. They rarely even see the cash leave our hands—let alone our bank account. It’s hard to make the connection between what things cost and how hard we have to work to afford them. Don’t even get me started on the environmental impact of it all. Or the incredible wealth gap in our country. Or any other complex financial topic that keeps me awake at night.

Sometimes I feel like a grownup in the Peanuts cartoons, droning on and on, “Wah wah wah wah,” in an effort to turn certain conversations with my kid into teachable moments. But does it stick? I see money lessons everywhere, but is he following along? Am I an effective teacher? I will never know how my son really sees the world, and I just have to be resigned to that.

One afternoon, while I was working on this essay, we were out at McDonald’s to get a treat, and I decided to ask him, “What have I taught you about money?”

“It’s not infinite,” he said, sipping his slurpee. “And things are expensive.” Noted.

As we walked out of the restaurant, a man held the door and asked me for change. I didn’t have any cash on me, but I turned back to apologize—I try not to ignore homeless people asking for money even when I don’t have cash on hand to help. I want my son to see that we treat everyone with respect, regardless of their situation.

Down the street and almost to the subway, a woman was selling arepas on the corner, while her young daughter, close in age to my son, stood nearby. Does he see the disparities between us and them as clearly as I do? I know how observant he is, so I’m sure he does, but he hasn’t said anything to me…yet.

I want to give my son the world. And I want to protect him from all that is bad while also equipping him with the skills to navigate difficult situations. To some extent, I think being a good parent means recognizing how little you really know. Most of the time the world makes absolutely no sense—even to grownups—but we can still work hard to teach our children to do better than the generations that came before them.

It’s also my responsibility to model good behavior, to be as open as is appropriate about our financial situation, to really listen when he has questions and do my best to answer them. I hope that will be sufficient.

I have embarrassingly high expectations for him—and myself. I want him to be kind and generous, to recognize his immense privilege, to understand the value of a dollar and not be wasteful, to save for the future and start investing early, to know it’s okay to spend money on things he loves and not feel too guilty when he makes a financial mistake (because we all do!), to donate to causes he cares about, to understand that wealth doesn’t equal happiness but a fully funded emergency savings account provides a lot of freedom, to find satisfaction in earning his own money for a job well done.

Of course, all of this is a lot to ask of an adult, let alone an eight-year-old kid. And when I look at this list, I realize these are things I also want for myself, and that I’m always working toward. It’s a lot to expect a child to already be the master of skills that some adults never grasp. But I’m here to try to make it happen—and to learn alongside him as we go.

Once again, I feel like I only scratched the surface on this topic! I want to hear from you. How are you teaching your children about personal finance? And what else should I write about kids and money?

Random Extras

I want to add that Michelle Teheux wrote a great piece about kids and money in her newsletter,

. I especially loved the anecdotes about her kids. I also got a lot out of ’s interview with Ron Lieber, author of The Opposite of Spoiled.Erika mentioned the other day that when we hit our Q4 goals (no pressure, Erika!), she’s celebrating by snagging this stunning sage suit by Argent. Meanwhile, I have my heart set on this tailored skirt. #partner

Don’t forget: Paid subscribers are automatically entered to win a monthly giveaway. This month’s prize is a copy of Bobbi’s book Launching Financial Grownups, plus an Owala water bottle. (Our friends gave Freddy one for his birthday, and I have stolen it; I love it so much!)4

Farnoosh is the author of many great books, including A Healthy State of Panic, and host of the So Money podcast. This summer she also wrote the very handy SoFi Guide to Family Financial Planning.

Bobbi also has a great newsletter,

, and she hosts financial education workshops, including ones focused on kids and money.Yep, I just casually dropped our new website into the mix! It’s been a pain point and a labor of love over the last year. Big thanks to

who clued me into Empress Themes, which look good and are easy to use. We have big plans for the Purse website, but for the time being, we’re embracing the old-school blog vibes. What’s old is new again, right? I hope to update the site regularly with more service-y type articles. Stay tuned!The sweepstakes is limited to readers within the U.S. It closes at 11:59 p.m. ET on October 31, 2024. To enter without upgrading to a paid subscription, please reply to this email by 11:59 p.m. ET on October 31, 2024, that you would like to be entered in the sweepstakes. If there’s any further questions, simply respond to this email and I will do my best to answer them.

I have so much to say on this topic especially now that my kids are older (19 and 16)

First off, what other people do or don't do with their money (give allowances or don't) is none of your business and what you do with yours is none of theirs.

Weave the money discussion into everyday activities. We are buying these apples at the grocery store this week because they are on sale, we buy no name items because they are cheaper and that leaves money for other things. Choices that we make impact money and what we can spend it on. When they got a little older and knew some math, we got into do we buy the bigger container for more money or the smaller for less... what is the price per serving so what is the best deal? We showed them our bills so they understood that we pay for electricity, to live in this house, to have the garbage picked up etc. We never did these as 'let's talk about money" now but just as an everyday part of life. When we went to Disney the first time, they each got a gift card with what their allowance was for souvenirs ( they were 7 and 4) and they got to pick where they spent their money. We explained that if they bought one thing, that would take all their gift card or they could buy 2-3 of the smaller things. My son had his card all spent on day 1 and my daughter had money until the last day. We never had to say no and be the bad guy, they had decided how to spend their money and only had themselves to blame if they they felt that they made the wrong choice.

When my daughter got her first tutoring job at 14 and wanted Vans shoes after I had already bought her running shoes, this was a want and not a need and therefore was on her dime. When she realized that she would have to work 4 hours to buy the shoes, she decided that they were not worth that. She continues to do this to this day.

There will always be people with more money and people with less and my kids know and have always known not to compare themselves to others. Some people have nice cars than we do, we prefer to spend our money on experiences than things. We don't judge what they spend their money on as that is their choice and we make ours. If we see unhoused people near a store, we buy them food and water and give it to them on the way out knowing that we do not carry cash or we volunteer at a soup kitchen to help support the community without having to spend the $$

My daughter is in college now- we pay for it 100% (which you will see is even more of a hot topic than allowances ;) If you were to ask her what we taught her about money, she may not go on for long but you will find her meal planning with her sale flyers on Sunday mornings, paying her credit card in full every month, using coupons for 2-1 deals at restaurants, using points programs etc. You really have to make it part of everyday! Also, just like everything in child rearing, what they do or don't do with what you taught them, the values you instilled in them really is out of your control. You just have to trust that you tried your best

Love this. I think it would be so interesting to talk to adults about the money lessons they got while growing up, what stuck, what didn’t - for example, my parents were very open about how tight our budget was ($50 at target for all my school clothes for the year!), and also taught me how to be responsible with money (including teaching me how to track spending + budgeting). But when I got my first real job and the freedom to buy what I wanted, things spiraled - and telling my parents who had educated me about the dangers of credit cards made me feel a DEEP sense of shame, even when ultimately, talking to them was the start of solving those problems. I also think it’s fascinating to talk to couples who grew up with different relationships to money - my parents always says “no” to things whereas my husband’s parents always said “yes” - and how we negotiate that these days.